A Long Island Mortgage Lender Serving Customers Nationwide

Owning a home is a significant achievement, and you merit the ideal home loan to match. Reliant Home Funding is dedicated to delivering exactly what you need. As a reliable mortgage lender based in Long Island and serving clients across the country, you can trust us to secure a mortgage program and interest rate tailored to your needs.

Our Expert Team Makes Home Loans Easy

-

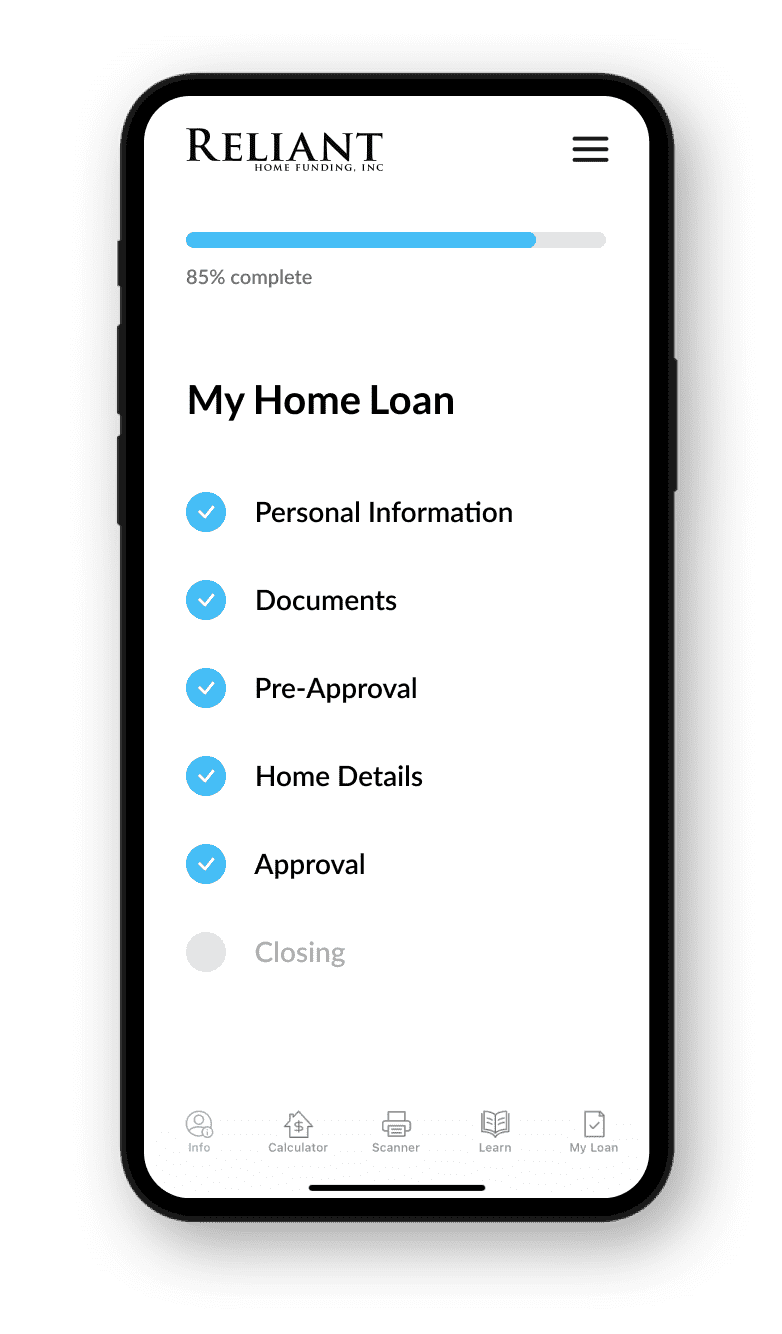

1. Apply simply & securely online

Ready to apply? Get the ball rolling with our simple and secure online application – it only takes a few minutes.

Apply Now -

2. Work with experts from start to finish

We’re experts so you don’t have to be. Our experienced team will guide you through the process from start to finish.

Meet The Team

A Five-Star Mortgage Experience

Buy the Home You Want

Whether you’ve nailed down the place you want to buy or you’re still looking, Reliant Home Funding will help get you through the door. We know that mortgages aren’t one-size-fits-all, and we’ll provide the right home loan for you.

Learn More

Refinance for a Better Fit

You already own a home, but your mortgage could probably work better for you. Expertly fitting home loans is what Reliant Home Funding does best. We’re committed to finding the best home loan program and interest rate for you.

Learn MoreWhy You Can Rely On Us

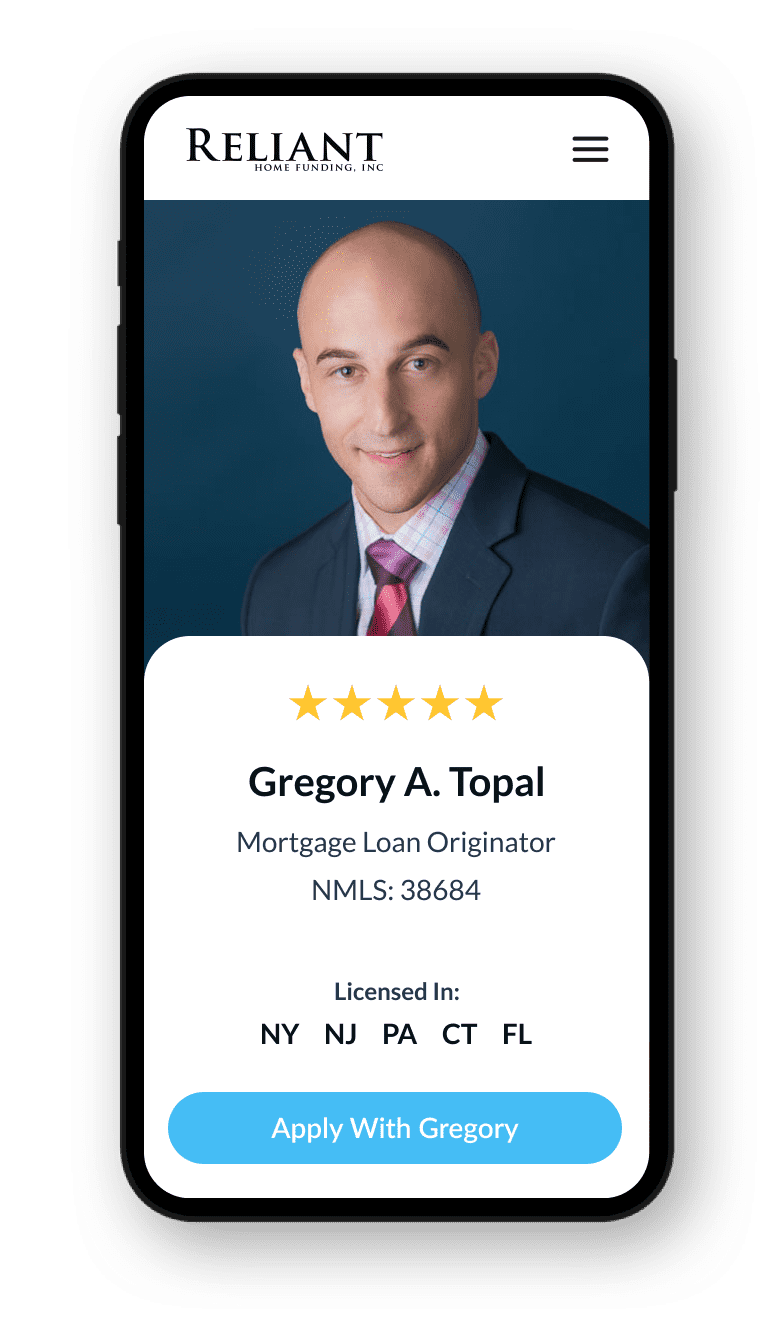

Our People Are Our Greatest Asset

Reliant Home Funding is a family-run business with a strong, valued team – not another nameless and faceless corporation.

Relationships > Transactions

We value changing people’s lives over the bottom line: our motivation and inspiration comes from helping clients into their dream homes.

Transparent & Consistent Pricing

With our highly responsive and knowledgeable loan officers, you’ll never be in the dark about your home loan process and pricing.

Explore Our Home Loan Resources

Compare Loans

Get an overview of the different kinds of loans we offer to see what might fit you.

Learn More

Mortgage Calculator

See how much you could borrow and what your payments might be with our calculator.

Learn More

Mortgage 101

Keep your finger on the pulse of the home loan market with the Reliant Home Funding blog.

Learn More

Secure the Right Home Loan for You.

Ready for a home loan that fits you perfectly? Get in touch with our experts today to secure yours.

Get My Rates